Last year, my DLP (domestic life partner/boyfriend/animal enthusiast) and I decided we were ready to take the step towards home ownership. Both of us had rented for many years, but we decided we wanted a little piece of the city to call our own. We’ve been in our home for almost a year and I’ve had some time to reflect on our experience. Below are my tips, taken from my perspective, on the home buying process.

**I am in no way a professional, but I have included links to the professionals who helped me along the way at the bottom of this post. They were wonderful and I can’t recommend them enough.

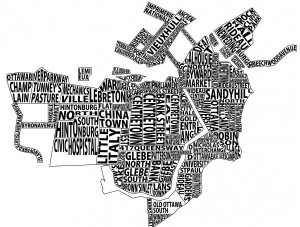

1. Location is everything. If you aren’t happy about the location, you probably won’t be happy in general. We were torn at first as to whether we were ready to transition from downtown to suburbs. Make sure that you’re ready to adjust! We ultimately went with suburbs; Shaun wanted outdoor space that was his own to enjoy and maintain. I wanted enough space to be able to host a dinner party. Yes, there are times that I wish I was living closer to downtown (especially when I had to spend $50 to cab home alone in a “party-cab” that had lasers…), but ultimately, I love our neighbourhood. We are close to everything we need, our families are close by and we love how much space we have.

2. Work with a realtor that you can trust. When we first started looking at homes, we did not have a realtor. We started by visiting a few open houses in the neighbourhoods we were interested to feel out the pricing. When you visit an open house, you sign in. And the realtor who is hosting the open house has access to your contact information. Real estate is a competitive industry, so I can appreciate the follow-up phone calls we received from some agents. But some of them verged on aggressive. The realtor we worked with was wonderful because she understood what we were looking for and cared more about our wants and needs than the “hard-sell”.

3. Shop around for your mortgage. Yes, mortgage rates are, in some ways, dictated by the government and the banking system at large. But there are always good deals to be found. We worked with a mortgage broker who did the shopping around for us. Even though he presented us with his best offer after verifying with multiple lenders, we still sat down at our own bank branches. You want to make sure you cover your bases so that you can rest assured you’re getting the best bang for your buck.

4. REALLY think about your financial situation. It’s so easy to get caught up when you’re in the process of buying a house. When you plan your budget, take into account all utilities (hydro, heat, water & sewer, phone, cable & internet), all previous payments that you’ve committed to (cell phone, gym membership, car payment, insurance), property taxes and cost of living (groceries, toiletries, entertainment, etc.) It’s so important to have a realistic and clear budget laid out before you decide how much you can afford to spend on a house. There would be nothing worse than buying a house and being stuck in it because you can’t afford to do anything else. Yes, it’s fine to spend more time at home – that’s why you bought it, to be enjoyed. But being “house-poor” is the last place you want to be.

5. When you pick your magic number, stick with it. Speaking of budgeting, at the time we were house hunting, we realized that with our interest rate, our mortgage would only increase by $27/month for each additional $5000 that was added to the purchase price of a house. It is REALLY easy to get caught up in the moment and go above your price-range when you see that number. I spend $27 a month on so many silly things, why not put it toward the house? This is a slippery slope, my friends. It leads back to my last point. Decide on your price range and stick within it.

Stay tuned for part 2, next week!

Our realtor: Brittany Goving, Keller Williams Ottawa Realty

Our mortgage broker: Nicholas Sylvestri, Ottawa Mortgage Brokers

This is an excellent article, Reese, exhibiting a lot of common sense and a great deal of practical advice for those readers who may be considering purchasing their own home.

I was happy to see that both you and your partner considered adequate space from both your standpoints as an essential feature in the acquisition of your house.

One must realistically acknowledge that your partner, the Big Guy, is ‘big’ and as a consequence requires space.

Holy Hannah Montana, do ‘party-cabs’ have lasers……….where have I been!

I am waiting with great anticipation for your next installment.

There is a more up to date version of the neighbourhood map of Ottawa on the Ottawa Past & Present here: http://www.pastottawa.com/design/hull-ottawa-neighbourdhood-map/2/